Taking investment decisions in a pandemic world

We hope you are all staying safe and healthy, wherever you are. These are crazy times and we – at MEDTEQ Invest – thought that we would share with the founders our perspective on VC investment during this pandemic.

Lately, we have seen a lot of tweets floating around citing ‘’business as usual’’ and ‘’we are open for business’’. While this might be true for some VCs, a lot is going on behind the scenes that we think you -founders- might want to consider when planning your virtual roadshow for your next raise:

- Adapting to WFH: With the current lockdown, investors are all working from home, with their kids. It is not an easy task to support the kids, the spouses and work on key decisions all at the same time from the same physical place.

- Virtual due diligence and site visits: most VCs and investors love meeting in-person the founding team and make site visits as part of their due diligence. This is an important part of the process that’s being wiped out with the current context. We don’t know yet how that will play out, but we expect existing relationships will play a tremendous role in building-up the VCs’ / investors’ pipeline in the next few months. It’s way easier to make investment decisions when a VC already knows the CEO, founding team, etc.

- Virtual investment committee meetings: Most VCs need to now go virtual for partner meetings and it is becoming a big challenge. Incremental information through coffee break chats is what usually makes a deal fly or fall. The good news is we have always held our investment committees virtually and we are less impacted in this way.

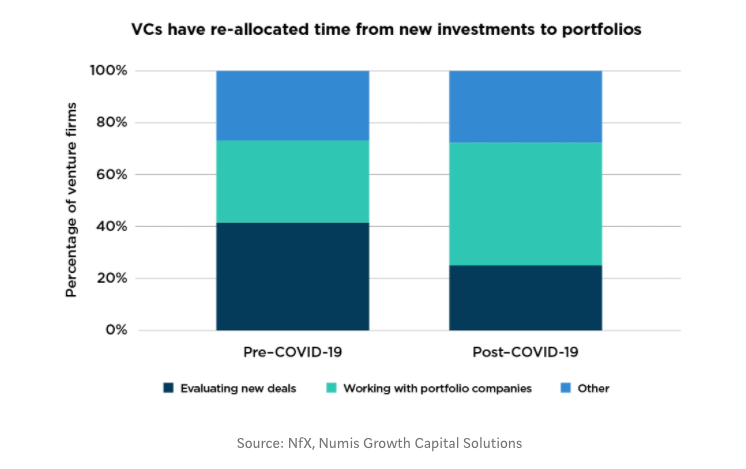

- Portfolio seeking attention: any VC’s portfolio will have companies in distress because they have seen their sales drop and their runaways shortened. Right now, many investors are focusing on helping their CEOs cut monthly burn, cut expenses and consider grants, loans and government support to extend runaway. This chart is a good illustration of the time re-allocation VCs had to go through:

- Angels and angel syndicates: angel investing will continue but at a much slower pace. Angels have seen their savings and investments lose 30% in less than 2 weeks and might prefer to keep their liquidity until the markets recover.

- The VC funders are stressed: the limited partners are usually overlooked in the equation. Often, VCs raise their funds from institutions, pension funds, etc. The recent stock market crash is affecting the rest of the limited partners’ portfolios since venture is often a part of their investments. These funders will expect their general partners – VCs – to be mindful of their capital which might contribute to the investment slow down. MEDTEQ Invest has one LP given that it manages a Federal program, so we aren’t impacted by LP sentiment.

While VCs are open for business, decision making is going to slow down as we are also watching how the pandemic will unfold. At MEDTEQ Invest, we think healthcare technology investment opportunities are even more of a priority today given all the shortcomings and flaws that have been exposed because of the pandemic and we continue our work of addressing the current pandemic needs and already think of ways to help make our healthcare system better prepared in the future. The consequences on the health system are going to persist after the pandemic and we have no intention to stop hearing your pitches. So if you are building a medical device or a digital health company – please reach out to us.